How To Open An Llc In Florida Online

However for the purpose of your business if you need to open offices or have a physical presence in a particular state you will need to form an llc in that state.

How to open an llc in florida online. It provides the limited liability of a corporation so your personal assets are protected in case of a lawsuit or bankruptcy and the operational flexibility of a partnership structure. Get workers compensation insurance coverage requirements depend on the type of business the number of employees and the organization itself. The articles of organization is the legal document that officially creates your florida limited liability company. An llc is essentially a hybrid between a corporation and a partnership. Updated october 30 2020.

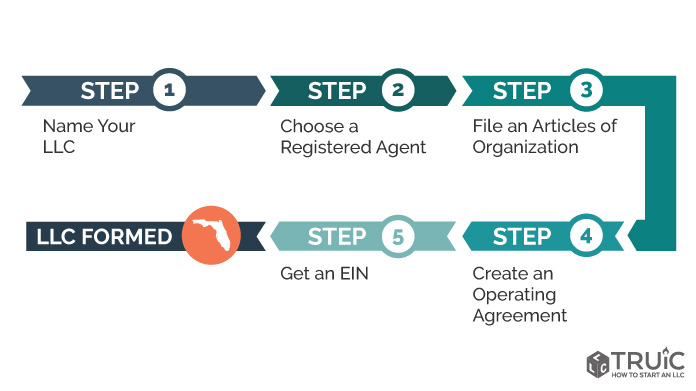

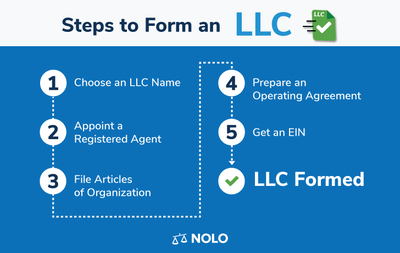

To start an llc in florida you will need to file the articles of organization with the florida division of corporations which costs 125. To open a us llc you don t even have to live in the us. 2 navigate to the llc e filing service. Gather all information required to complete the form. Once on the sunbiz site you will want to click on a link at the top of the page titled e filing services.

File your florida llc s articles of organization with the state and pay the 125 state filing fee. Your florida llc articles of organization will include the following information. It is usually advisable to form an llc in a state without state taxes so you only have to handle us federal taxes. Have a valid form of payment. Adhering to florida llc requirements is important when forming and operating an llc by sticking to all requirements involving taxes fees deadlines etc your business will maintain its active status.

If your llc has employees. This can be done online at the myflorida sunbiz website by mail or in person. Florida is generally a great place to start a limited liability company llc. Review the instructions for filing the articles of organization. You ll need to do the following things.

Register with the florida new hire reporting center to report new and rehired employees. Even a traditional llc formed in florida will benefit from no state income taxes no capital gains or death taxes low property taxes and the fewer formalities and cheap annual maintenance associated with llcs when compared to starting a florida corporation.