How To Open Up An Llc In Nj

An llc is essentially a hybrid between a corporation and a partnership.

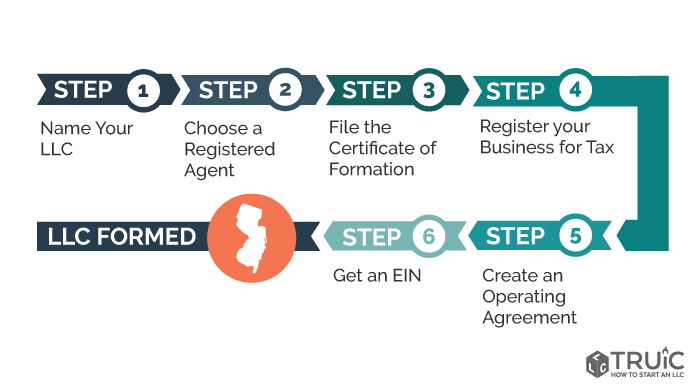

How to open up an llc in nj. Built as open source the business portal is an open source project meant to serve as a resource for anyone who is looking to create an online resource for their own business community. The certificate of formation is the legal document that officially creates your new jersey limited liability company. To ensure that your new business complies with your state s legal requirements at all steps in the llc formation process you may wish to consult an experienced small business attorney in your area. Your next major task is going to be registering your business with the state of new jersey. If you do not have a certificate of good standing at this time you will need to obtain one before forming a business in the state of new jersey.

Forming a limited liability company llc can be a long term benefit for your new business but the process can be complicated. To open a us llc you don t even have to live in the us. A limited liability company llc is a hybrid of a corporation and a partnership. Llcs are generally easier to set up and more flexible than corporations and they tend to have fewer ongoing reporting requirements. When you want to start a new business in the state of nj llc pa dp non profit etc when you need to authorize a legal entity in nj for your business in another state you should use the online registration form instead if.

Like a partnership profits and losses can be divided among the owners any way they want. You have already formed authorized your business in nj and need to register for tax purposes. An llc s owners are called members and in many states you can have a one person llc. To form an llc in new jersey you will need to file the certificate of formation with the state of new jersey which costs 125. Annual filing fees are 50 and corporations must pay a minimum 500 annual tax fee.

You will need to upload a certificate of good standing from your state of incorporation to successfully file. You can register your new business in person at the nj department of treasury online at www newjerseybusiness gov or by regular mail by completing form nj reg. Like a corporation it protects owners from lawsuits and bankruptcy. Register your new jersey business. The name you are filing must match the certificate of good standing exactly including.

If you are starting a nonprofit organization the filing fee is 75. An llc s corp c corp or sole proprietorship. Before you can do that though you have to figure out what type of business structure you want to form. It provides the limited liability of a corporation so your personal assets are protected in case of a lawsuit or bankruptcy and the operational flexibility of a partnership structure.