How To Register The Ppp Loan In Quickbooks

Credit ppp loan or whatever you want to call it as a liability.

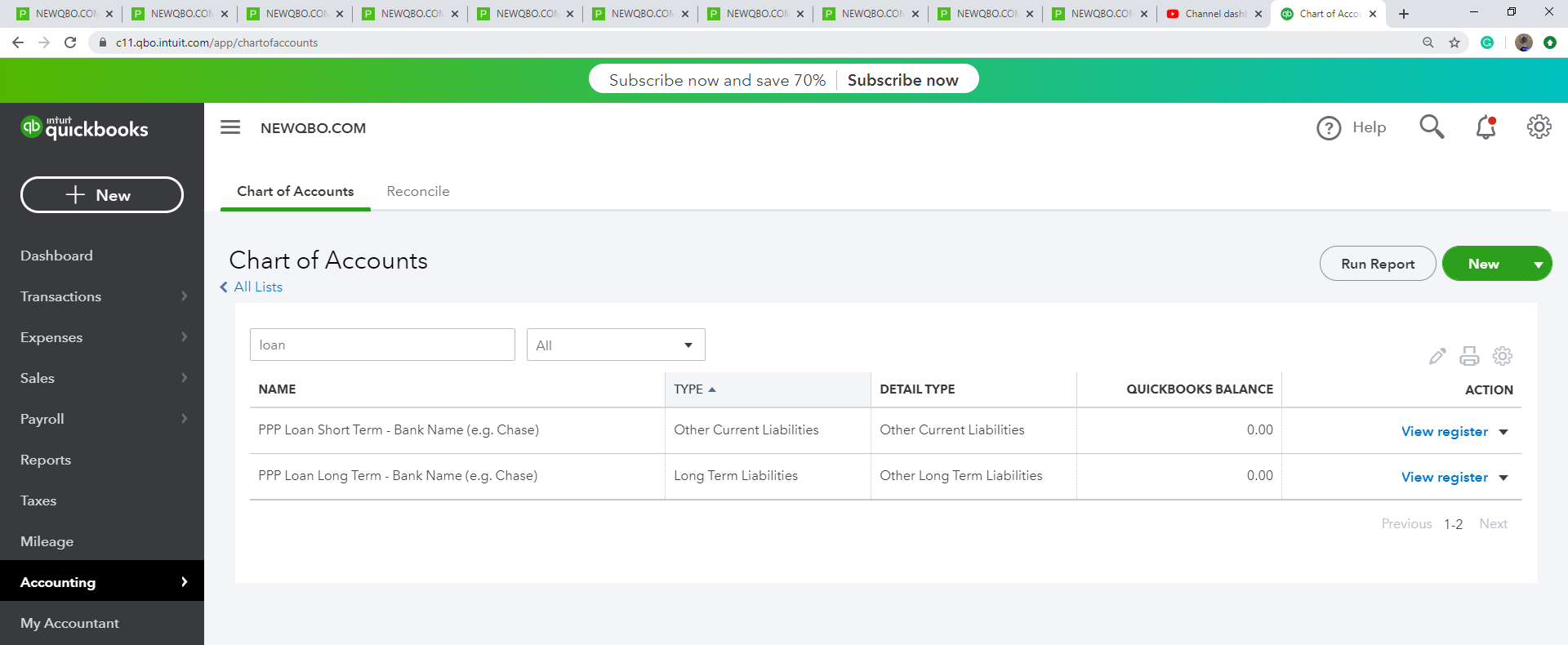

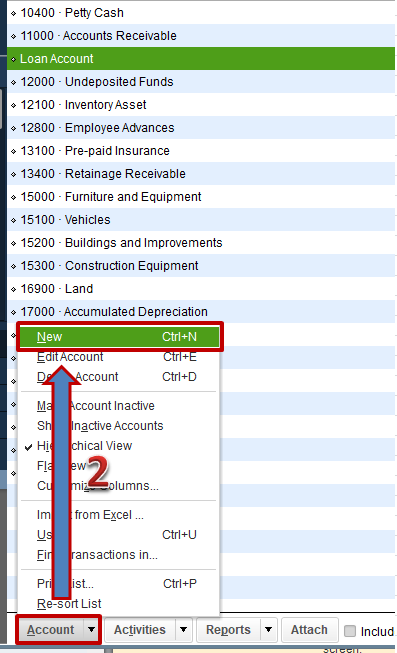

How to register the ppp loan in quickbooks. Additionally if you have quickbooks online plus you can add a class called ppp and tag expenses to it. Did your business receive the ppp paycheck protection program loan. Borrowers seeking loan forgiveness for ppp loans can apply for forgiveness through their lenders. Many tech providers within the accounting space have rapidly added tools to help small businesses cope with business disruption during the covid 19 pandemic including some pricing relief. Navigate to your chart of accounts by selecting accounts on the left hand side and choose chart of accounts.

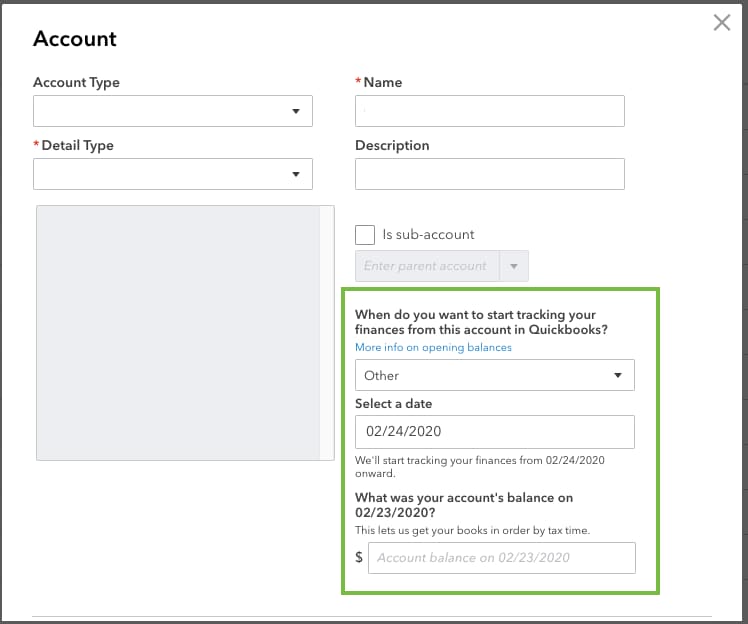

Covered expenses should be allocated to their normal expense accounts but all covered expenses should be recorded in our spreadsheet here. In the top right click new to create a new account. They ll need to verify the number of employees on the payroll and their pay rates during the loan forgiveness covered period after their loan was disbursed. Once all the ppp funds are used up your lender will ask you to show how you spent the ppp funds. That will open up the chart of accounts screen with the list of all of your accounts.

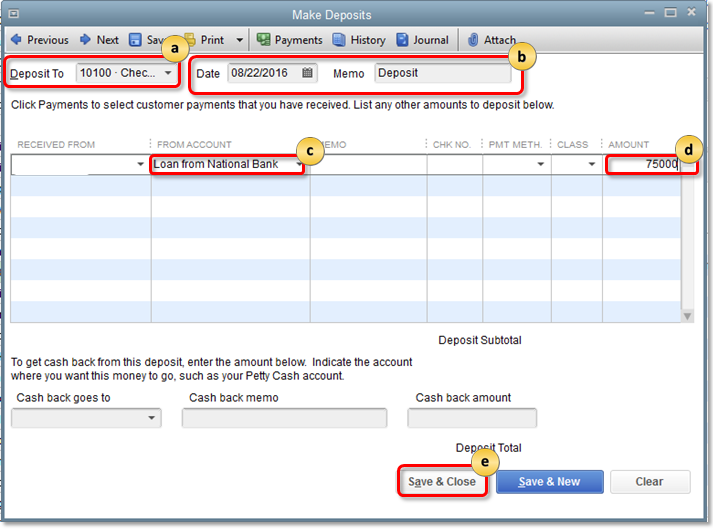

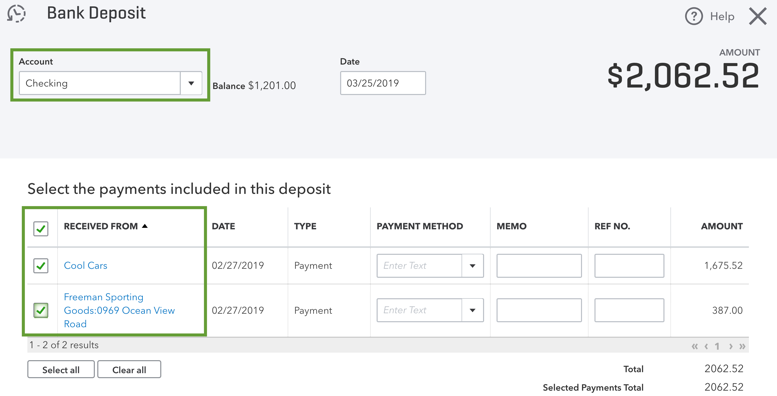

Today we will teach you how to record and track your ppp paycheck protection program. Creating a payroll report may help verify these numbers and expedite the auditing process. In the chart of accounts select account then select new select bank click continue enter a name for the account like ppp loan funds click sub account of and choose the bank account from the drop down. Record the initial deposit to the sba loan account adding a balance to the loan. Creating a liability account to record loans in quickbooks online.

If you can 110 guarantee that it will all be forgiven set it up as a short term liability since the life of the loan is only 8 weeks if you anticipate that even a portion may not be forgiven maybe not rehiring enough full time equivalents by june 30 set it up as long term as it has a 2 year repayment plan. Select your new ppp loan account enter amount of the loan in credit column line 2 account. New to intuit s quickbooks is the paycheck protection program ppp center and the latest update adds a loan forgiveness estimator and ppp specific reports to quickbooks online among other tools. The loan will either be forgiven in full or the lender will disallow some expenses and require a portion of the loan to be repaid.